How to Tell If Your College Debt Is Unsustainable

According to the latest data, 43.2 million individuals in the United States have federal student loan debt.

A decade ago, the total amount of outstanding student loans was a little over $1 trillion — now, it’s up to $1.7 trillion.

So, how much student debt is too much?

Whether or not student debt is beyond acceptable depends on factors such as one’s current financial situation, institution and academic program of choice, and the average salary in an intended career.

Borrowing hundreds of thousands of dollars using a mix of federal and private loans is possible.

However, that’s not necessarily a smart move in financing your pursuit of an undergraduate degree.

You can determine whether or not you are about to borrow too much money for your college education, and it’s by using your prospective starting annual salary and monthly income:

- Many student loan experts agree that you should avoid taking out a loan whose amount exceeds your projected starting income per month after graduation.

- According to the US Department of Education, you should avoid taking on a student debt payment that exceeds 8% to 10% of your potential income per month.

Believe it or not, you can graduate from college without having to worry about repaying any debt.

As a matter of fact, according to the Association of Public and Land-Grant Universities (APLU), more than 40% of students at public four-year institutions complete their degrees with zero debt!

Graduating with no debt would be great.

However, it would be unwise to compromise your academic and career goals simply because you don’t want to use a fraction of your salary each time to repay the money you owe the government or a private lender.

Making the right choices can help keep your educational debt to a minimum.

Which Student Loan is Right for You

It’s after exploring all alternative funding options that you should consider applying for a student loan.

Generally speaking, taking out a loan should be any undergraduate student’s last resort.

Having an idea of how much is too much for college by considering your current and future financial situation allows you to determine better if the amount of money you are about to borrow is worth it.

Federal vs. Private Loans

There are two major sources of student loans:

- Federal

- Private

Between the two sources of educational loans, federal loans are on top in terms of the amount of money you can borrow and the availability of flexible student loan repayment programs.

Experts agree that you should exhaust all avenues for federal aid before taking out a loan.

Private loans have certain conditions and terms that make them harder to obtain than federal loans.

Also, most of them have very limited repayment plans — as a matter of fact, some college students who take out private loans must start making repayments while still in school!

Two of the most popular federal student loans for undergraduate students are:

Direct Subsidized Loans

Direct subsidized loans are for students who demonstrate financial need.

Also known as direct Stafford loans, they are available to undergraduates only.

While students who take out direct subsidized loans should repay the amount with interest, interest does not accrue until borrowers have graduated or left college.

As a matter of fact, it’s the government that takes care of interest while they’re still in school.

However, direct subsidized loans have lower loan limits.

Direct Unsubsidized Loans

Unlike direct subsidized loans, direct unsubsidized loans are not need-based.

So, in other words, even undergraduate students from wealthy families are eligible for them.

Also referred to as unsubsidized Stafford loans, they are available to both undergraduate and graduate students, and they have higher loan limits than those who take out direct subsidized loans.

However, interest accrues from the time of disbursement, and the US government doesn’t help with it.

When it comes to private loans, there are many lenders you can run to:

- Banks

- Credit unions

- Finance companies

- Colleges and universities

- State agencies

Despite having numerous sources, private loans come in two forms only:

- Private student loan

- Private parent loan

There are a few advantages private student loans have over federal student loans, such as:

- Quicker application process

- Higher borrowing limits

- Rewards for having good credit

- Non-need based

However, there are also downsides to private student loans:

- A cosigner may be necessary

- Ineligible for debt forgiveness

- Interest rates may change

- Higher risk of borrowing more than necessary

Keeping Your Student Debt Manageable

Sometimes, a lender, whether the federal government or a private one, will offer you more than expected.

Although it can be enticing to take out the entire amount offered to you to cover as much of the total college costs as possible, it’s a must to keep in mind that you will have to pay back every penny.

Plus interest!

So, instead of wondering how much college debt is too much, your best bet is to figure out how much you need exactly.

There are various ways to determine the right amount of student loan to take out, thus saving you from the burden of repaying borrowed money for most of your professional life.

Consider Prospective Salary

How much student debt is too much can vary, depending on the borrower’s financial situation as a college student and future salary as an employed bachelor’s degree holder.

As mentioned, a good rule of thumb is to borrow less than how much you might make after college.

It takes an average borrower around 20 years to repay their student loan debt.

Because of this, you should factor salary increases into the equation.

For example, the table below shows the salary progression of certain majors:

| Major | Early-Career Median Salary | Mid-Career Median Salary |

|---|---|---|

| Chemical Engineering | $68,000 | $103,000 |

| Computer Engineering | $65,000 | $106,000 |

| Electrical Engineering | $65,000 | $100,000 |

| Aerospace Engineering | $64,000 | $100,000 |

| Industrial Engineering | $64,000 | $87,000 |

| Mechanical Engineering | $63,000 | $98,000 |

| Computer Science | $62,000 | $95,000 |

| General Engineering | $60,000 | $88,000 |

| Civil Engineering | $60,000 | $90,000 |

| Business Analytics | $57,000 | $88,000 |

| Construction Services | $56,000 | $85,000 |

| Economics | $55,000 | $90,000 |

| Finance | $52,000 | $85,000 |

| Mathematics | $50,000 | $80,000 |

| Nursing | $50,000 | $70,000 |

| Accounting | $50,000 | $72,000 |

| Engineering Technologies | $50,000 | $80,000 |

| Physics | $48,500 | $94,000 |

| Physical Sciences | $46,000 | $75,000 |

| Architecture | $45,000 | $75,000 |

| Business | $45,000 | $70,000 |

| International Affairs | $45,000 | $75,000 |

| Medical Technician | $42,600 | $64,000 |

It’s worth pointing out that the prospective salary rule is far from being accurate when it comes to determining how much debt is too much for college.

For instance, there’s no guarantee that you will have the job of your dreams.

Suppose that your first job after earning your bachelor’s degree pays something around $30,000 every year, which means that your gross income is $2,500 per month.

Let’s suppose, too, that your student debt is also $30,000.

Then, it means that your take-home pay per month is close to $1,800 — that’s after federal and state taxes as well as the $304 for student debt payment (based on a 10-year repayment plan with 4% interest).

Attend the Right School

The lower the cost of attendance, the lower the need to borrow money.

It goes without saying that attending a public institution may keep you from needing to borrow money — again, over 40% of public university graduates have zero debt — or keep your loan to a minimum amount.

However, it should be noted that private schools tend to have more generous financial aid packages.

This is when the absolute importance of doing the math by deducting scholarships and grants from the sticker price to determine the net price of college comes in.

How much is too much for college tuition, therefore, depends on the net price and expected family contribution.

Believe it or not, in which state you work on a college degree can impact your student loan.

Some states have higher student loan debt because they have more postsecondary institutions and students, which results in state aid being scarcer as it’s split among more degree-seeking individuals.

As a result, college students take out federal and private student loans to bridge the financial gap.

Based on the latest information from the Education Data Initiative, the following are the top 15 states with the highest average federal student loan debt:

| State | Average Debt |

|---|---|

| District of Columbia | $54,668 |

| Maryland | $43,345 |

| Georgia | $41,951 |

| Virginia | $39,561 |

| Florida | $38,931 |

| South Carolina | $38,682 |

| Delaware | $38,373 |

| Illinois | $38,198 |

| New York | $38,139 |

| North Carolina | $38,134 |

| Oregon | $37,611 |

| Alabama | $37,508 |

| Mississippi | $37,396 |

| California | $37,162 |

| Colorado | $37,103 |

On the other hand, here are the top 15 states with the lowest average federal student loan debt:

| State | Average Debt |

|---|---|

| North Dakota | $29,083 |

| Iowa | $30,580 |

| Wyoming | $30,631 |

| South Dakota | $31,014 |

| Oklahoma | $32,031 |

| Nebraska | $32,156 |

| West Virginia | $32,174 |

| Wisconsin | $32,289 |

| Rhode Island | $32,369 |

| Kansas | $32,922 |

| Idaho | $32,972 |

| Kentucky | $33,097 |

| Utah | $33,110 |

| Texas | $33,301 |

| Maine | $33,684 |

Explore Various Options

Generally, it’s a good idea to explore other federal financial aid options such as scholarships, grants, and work-study programs before applying for federal student loans.

It’s only after doing so that it becomes recommendable that you turn to private student loan borrowing.

Still, refrain from taking out the full amount offered.

Remember to borrow only the amount you need after considering all major role players in the equation, from the cost of attendance, scholarships and grants, and prospective salary.

Besides the tips discussed above, let’s take a look at some other steps worth considering:

Earn College Credit in High School

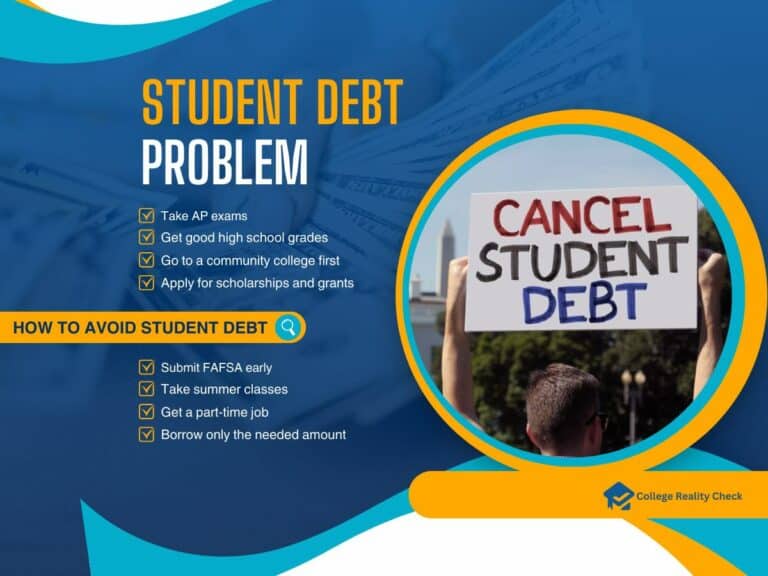

Avoiding too much student debt or the need to borrow money for college starts in high school.

Taking AP exams and getting a score of 4 or 5 in each may allow you to earn college credit, although it’s a must to apply to a college that not only accepts AP exams but also gives college credit generously.

Choose the Right Major

College is a form of investment, and investing in something that allows you to recoup the money you paid for college in the shortest period helps you repay your student debt the quickest.

Hands down, STEM majors are at the top of any listing of majors with the best ROI.

Work to Offset Some College Costs

Earning while working on your college degree can help lower or even eliminate the need to take out a loan.

You can go about this by finding a part-time job (opting for one with a tuition reimbursement program is a huge plus!) or requesting work-study when you fill out the FAFSA form.

Apply for Various Scholarship Programs

Unlike student loans, scholarships do not need any repayments — they’re free money.

Scholarships can come from different sources, from the federal government to private businesses and organizations. Apply to as many of them as you possibly can so you can get your hands on as many gift aid and lower the cost of college.

Take on a Public Service Job

Have you heard of the Public Service Loan Forgiveness (PSLF) program?

Making 120 on-time loan payments and applying for it to work full-time as a public service worker for a qualified organization gets some of the amount of money you owe the federal government forgiven.

Related Article: Is the Google IT Support Professional Certificate Worth It?

Disclaimer: The views and opinions expressed in this article are those of the authors and do not necessarily represent those of the College Reality Check.