How to Pay for College: 10 Money Saving Strategies

College doesn’t come cheap, which is why paying for an undergraduate degree can be a daunting task. With careful planning and consideration, however, it’s possible to make the cost of attendance reasonable and manageable.

Applying for financial aid like grants, scholarships and work-study programs may be done to pay for college. Parents and students themselves may also open college savings accounts or take out education loans. The cost of attendance may be reduced by applying to the right colleges and getting good grades for eligibility for certain scholarships.

In this post, we will talk about 10 of the top ways to pay for college, and they are as follows:

- Federal financial aid

- State aid

- Grants and scholarships

- Federal work-study

- Student loans

- Parent PLUS loans

- EE saving bonds

- 529 Plan

- Coverdell ESA

- Mutual funds

How Much Do You Need to Save for College

The amount of money you need to save for college will depend on factors such as how soon you start saving for it, what type of degree-granting institution you wish to attend and which program you like to enroll in. It’s also important to consider how you intend to save money for college as there are many different options.

Generally speaking, the sooner you prepare for college costs, the less you are likely to worry about expenditures.

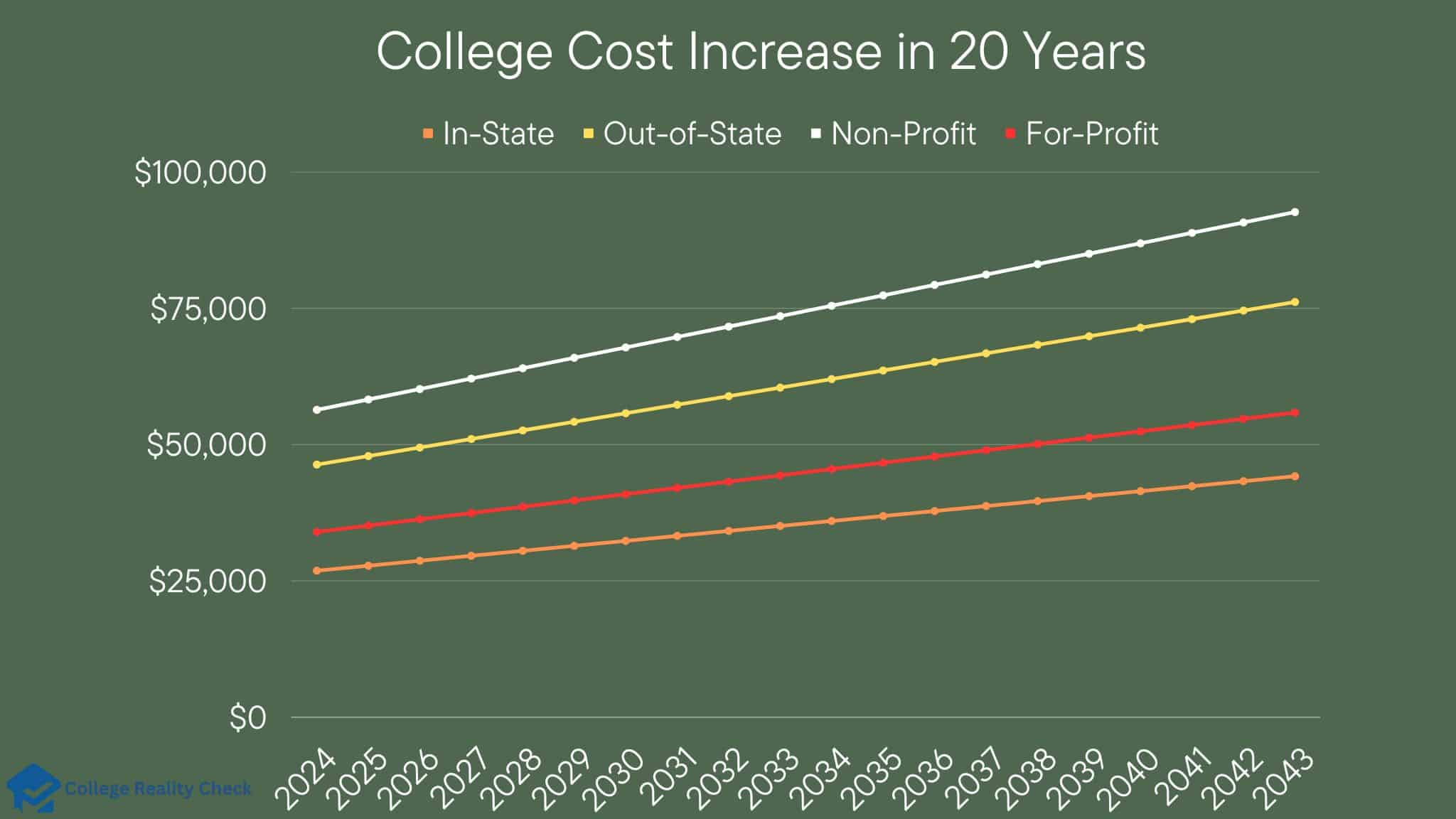

Cost of College

The cost of attending a 4-year postsecondary institution in the US amounts to $36,436 per year per degree-seeking student, according to the Education Data Initiative.

Of course, the average cost can vary by type of institution — that’s equivalent to $26,027 for in-state public colleges, $44,807 for out-of-state public colleges, $54,501 for private non-profit colleges and $32,895 for private for-profit colleges.

Read Also: How to Get into a Good College

Given that college costs tend to increase at a rate of 3.5% per year, a college degree is bound to get more and more expensive.

This means that going to a 4-year school will increase by the amounts below per year:

- In-state public colleges: $910.94

- Out-of-state public colleges: $1,568.24

- Private non-profit colleges: $1,907.53

- Private for-profit colleges: $1151.32

The following table demonstrates how college will cost every year for the next 2 decades:

Compound Interest

Simply put, compound interest is the interest on a savings account that’s calculated on both the initial amount of deposited money (principal) and the accumulated interest from all previous periods.

On the other hand, simple interest grows based only on the money deposited.

What’s so nice about compound interest is that, over time, the interest earned grows exponentially.

As a general rule of thumb, the longer the principal is allowed to grow over a long period, the more significant the compound interest, which is beneficial for students who are intending to attend college in the future where tuition and fees are very much likely higher.

Also worth noting is the fact that interest may be compounded on a daily, monthly, quarterly or annual basis. It can be based, too, on some other period, such as semi-annually.

The more often the interest is compounded, of course, the more money is earned by the depositor.

Because of how it works, compound interest can be leveraged to one’s full advantage by saving early. The sooner the parent can start saving for his or her child’s college education, the better — some even recommend starting saving even before the child is born to secure a more solid financial foundation for the pursuit of a college degree.

Why You Shouldn’t Save College Money in Child’s Name

The primary reason why it’s usually a bad idea for parents to keep college savings in the child’s name is that it can reduce his or her eligibility for financial aid when the time comes for him or her to work on an undergraduate degree.

When calculating financial aid, the financial aid office of every college considers a larger percentage of the student’s assets to be available for paying tuition and fees. So much so that, as a matter of fact, FAFSA uses less than 5% of the assets of parents, while it uses 20% or more of the assets of the child.

A couple of other reasons exist why parents shouldn’t save college money in their child’s name.

Not all young individuals, for instance, are capable of making the smartest choices by 18 years old — instead of using the money to fund their postsecondary education pursuits, they may instead, say, get a car or travel for leisure.

Additionally, money put in the child’s name for his or her college is no longer the money of the parent but the student. This means that the parent won’t be able to borrow money from the account. Because life is full of surprises, many of which are terrible ones such as losing a job or going through a financial crisis, this can be a risky move.

However, there are also a few perks that come with putting college funds in the name of little ones.

For one, it allows the child to actively participate in the college planning and preparation phases. Also, a child is in a lower tax bracket than his or her parents, which is good for interest.

10 Ways to Pay for College

Paying for college can be done by applying for financial aid such as grants, scholarships and work-study as well as using savings and earnings from investments and taking out loans.

Since options are varied and some can be utilized at the same time, it’s important for both parents and students, too, to carefully plan how they will be able to afford postsecondary education.

While the steep cost of college can be shouldered differently, below we will discuss some of the top ways.

1. Federal Financial Aid

Federal financial aid refers to financial assistance coming from, as the name suggests, the federal government to help college students pay for their education. The US Department of Education is the primary provider of federal aid.

Aid available from the federal government comes in 3 forms, and they are the following:

- Grants

- Loans

- Work-study

Simply put, grants are federal aid that does not have to be repaid by students who receive them, except under certain circumstances. At least a part of them may have to be paid back by students if they change their enrollment status (from full-time to part-time), receive other financial aid that lowers their need for grants or drop out of college.

The largest federal grant offered by the US Department of Education to undergraduates is the Pell Grant, which is designed to help students from low-income backgrounds.

Each year, around 7 million undergraduate students receive Pell Grants, each one getting $4,491 on average.

On the other hand, federal student loans have to be repaid after college, unlike federal grants, and with interest, too. There are different kinds of federal loans, and some of them are listed below:

- Direct subsidized loan

- Direct unsubsidized loan

- Parent PLUS loan

A direct subsidized loan is money borrowed based on the cost of attendance and the ability of the student’s family to pay. A direct unsubsidized loan, meanwhile, is not based on need.

In a few, we will talk about both direct PLUS loans and work-study — so keep reading!

2. State Aid and Grants

State aid is financial assistance that a state gives to eligible resident students to lower their educational costs.

Although it’s true that most state aid is offered to local students attending in-state institutions, out-of-state students may also be eligible for some forms of state-based financial aid.

There are 3 different forms of state aid:

- Grants

- Scholarships

- Tuition breaks

State aid grants and state aid scholarships are commonly offered to students to encourage them to attend institutions in their respective home states. State aid grants are usually need-based or need-based with a merit component. On the other hand, state aid scholarships are commonly merit-based.

In most instances, public colleges and universities offer tuition breaks to local students who might be looking to attend colleges outside of their home states to persuade them to stay and pay cheaper.

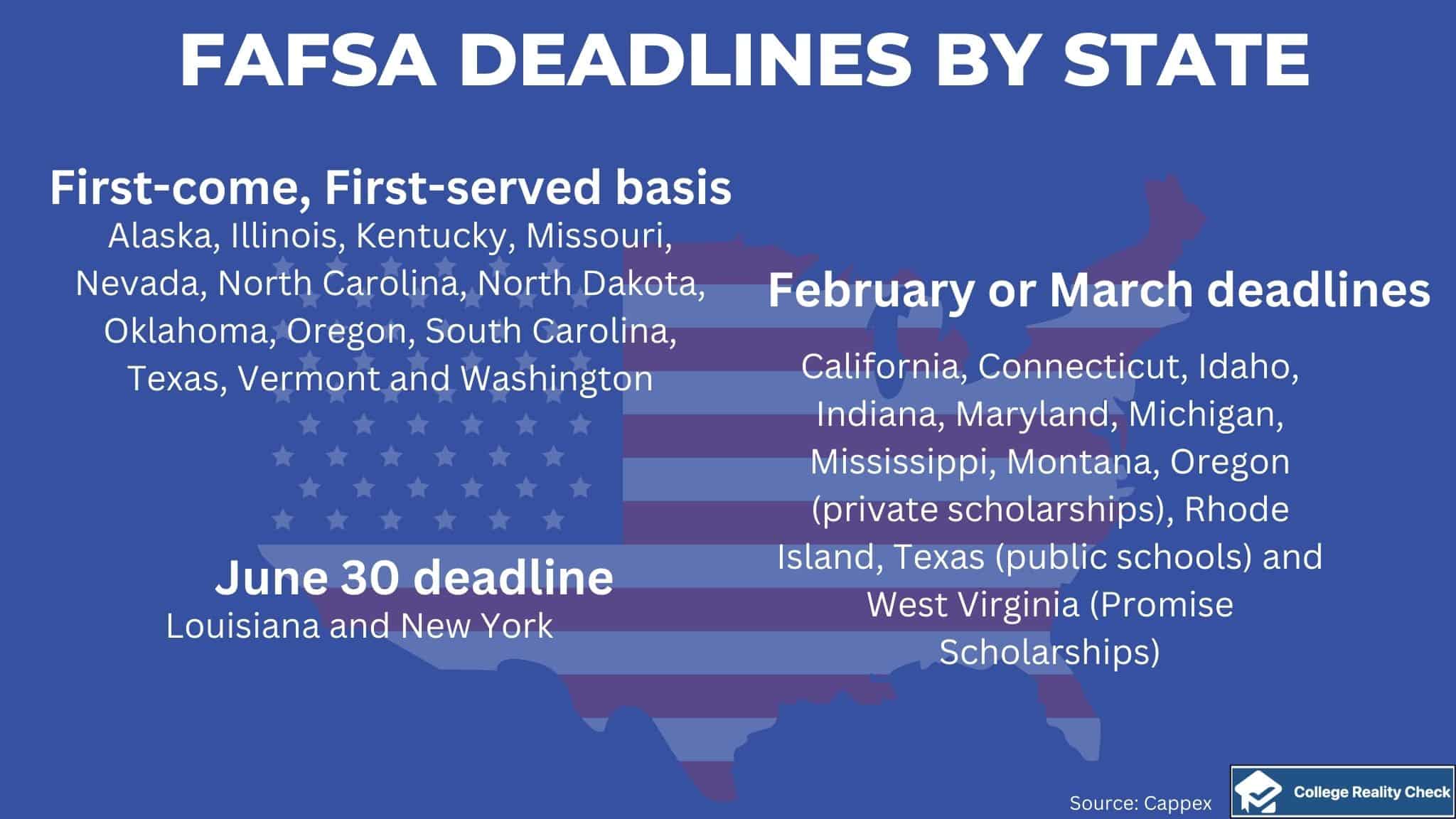

Filling out the FAFSA form is necessary for applying for state aid.

However, it’s important for college-bound students to note that certain states may require additional paperwork. Checking for state-specific requirements and deadlines, needless to say, is of utmost importance for in-state students.

Speaking of deadlines, some state aid comes on a first-come, first-served basis — there are a total of 13 states who award state aid in this manner, including Alaska, Kentucky, Nevada, North Carolina, Oklahoma, Oregon and Washington.

This means that students must complete the FAFSA (as well as any other application form necessary) early to maximize their eligibility.

3. Grants and Scholarships

Both grants and scholarships are types of financial aid that students don’t have to pay back. Because of this, they are also sometimes referred to as gift aid.

Many use grants and scholarships interchangeably, thinking they are one and the same.

It’s true that grants and scholarships have certain things in common, such as they are essentially free money given to students to pay for their college education and can come from various sources, namely:

- Federal and state governments

- Colleges and universities

- Private organizations

However, upon closer inspection, there are a few differences between grants and scholarships.

The vast majority of grants are need-based.

So, in other words, they are often awarded based on a college student’s financial situation. On the other hand, most scholarships are merit-based, which means that they are awarded to degree-seeking student’s academic achievements, field of study, extracurricular activities, athletic abilities and others.

To apply for grants and scholarships, in most instances, students will have to fill out the FAFSA form and/or submit a CSS Profile, depending on the policy of the postsecondary education.

Also, they will usually have to do it every year.

The average federal grant award each student receives on a yearly basis amounts to $5,179. Around 42% of all undergraduate students receive federal grants.

Meanwhile, it’s estimated that the US Department of Education awards about $46 billion in scholarship money every year, although only 7% of all college students will receive them.

4. Federal Work-Study

Originally referred to as the College Work-Study Program and now usually simply referred to as work-study, the Federal Work-Study (FWS) Program provides funds to low-income students that they need not pay back.

But instead of the federal government awarding them money, students should work to earn them.

So, in other words, it’s a way for college students to make money to pay for their postsecondary education through part-time jobs, which are usually on-campus but can also be off-campus in some instances.

Some institutions may match students to jobs, although there are also those that require students to look for and apply for jobs.

Unfortunately, not all colleges and universities participate in FWS — only around 3,400 of them do. Some schools where students may apply for work-study and receive FWS funds include:

- Brown University

- California Institute of Technology

- Cornell University

- DePaul University

- Georgetown University

- Mississippi State University

- Oregon State University

- Texas State University

- Tulane University

- University of Houston

- University of Washington

- Vassar College

- Villanova University

Unlike most other financial aid, work-study earnings are not applied directly to tuition and fees. Instead, students receive a paycheck, just like normal employees, which they may use for day-to-day expenses that they have.

Students may earn anywhere from $2,000 to $5,000 per year, depending on the school and job.

There are a couple of important things college students should know before applying for FWS: work-study jobs may be limited and getting work-study funds is not guaranteed from year to year.

5. Student Loans

Student loans are a lump sum of money that college students borrow to help them pay for college. Unlike federal grants, they have to be repaid with interest by borrowers after graduation.

Money taken out by college students cannot be used for just about anything. Student loans must be used for eligible educational expenses.

They include tuition and fees, room and board, textbooks, computers, transportation expenditures and even study abroad costs. Also included is childcare for students who have kids.

There are 3 different sources of student loans, and they are as follows:

- Federal government

- State government

- Private companies

The majority of educational debt in the US is made up of student loans. Of those, around 92% are federal debt — as of this writing, about 43 million borrowers owe the federal government a total of $1.6 trillion.

Younger individuals between 25 years old and 34 years old hold the bulk of student loan debt. However, many middle-aged and older people still have an educational debt to pay off. As a matter of fact, those who are aged 35 years old to 49 years old are indebted with over $620 billion in student loans.

Meanwhile, there are 2.4 million borrowers 62 years old or older that owe $98 billion in student loans.

To determine whether or not you are eligible for federal or state student loans, you will have to fill out the FAFSA form.

On the other hand, if you are ineligible for it or don’t consider it as an option, you will have to apply directly to a private lender, which is commonly a bank, credit union or online lender.

6. Parent PLUS Loans

Also referred to as direct parent loans for undergraduate students, parent PLUS loans are loans that parents can borrow on behalf of their children working on an undergraduate degree.

Unlike other types of loans, such as the ones we mentioned earlier like direct subsidized loans and direct unsubsidized loans, parent PLUS loans require a different application and approval process.

While eligibility is not based on a student’s demonstrated need, a credit check is required to determine whether or not there’s adverse credit history.

Each year, around 600,000 parents take out loans for their undergraduates.

The maximum PLUS loan amount a parent can borrow is the cost of attendance minus any other financial assistance his or her child receives. Needless to say, the loan has to be repaid, with an 8.05% interest rate as of this writing.

Funds received will be used by the college to pay for the child’s tuition and fees, room and board as well as other school charges.

The school will give any remaining money to the parent to help pay for other college-related costs, or, with the authorization of the parent, directly to the undergraduate student.

Before the parent can apply for parent PLUS loans, the child must file the FAFSA and meet eligibility requirements.

7. EE Saving Bonds

Series EE savings bonds, or simply EE bonds, are a type of savings bond that is low-risk and guaranteed to double in value after 20 years. The US Department of Treasury, which issues EE bonds, guarantees that the bond will be paid back after a couple of decades together with interest — as of this writing, that’s 2.50%.

Even though just about every student who is planning on pursuing a college diploma could benefit from buying EE bonds, those who are residing or studying in states or cities with high taxes could leverage it to their utmost advantage.

That’s because the interest earned is free of federal, state and local taxes.

However, it’s important for degree-seeking individuals to use their savings to pay for qualified college expenses, which include tuition and all sorts of fees, such as lab and course fees, but not room and board. Other criteria to meet to keep EE bond interests free of taxes include the following:

- The bond must be issued in the name of a parent or both

- The bond’s owner or purchaser must be not less than 24 years old

- The bond must be redeemed by the owner in the year it’s used to pay for qualified education expenses

One of the nicest things about an EE bond is that it only costs a minimum of $25 or any other amount above that to the penny. For instance, you could buy it for, say, $25.52 or $50.77.

8. 529 Plan

529 savings plans are state-sponsored investment plans that allow account holders to save money for their chosen beneficiaries and pay for their education expenses. What’s so nice about these plans is that funds can be withdrawn tax-free to be used to cover almost any type of college-related costs.

Besides being tax-free for as long as certain conditions are met, 529 plans also have no minimum contribution amount.

But to open an account, one should contribute $25 or $10 per month through an automatic investment plan or $30 per quarter.

Also, just about anyone, family members and friends, can contribute to a single 529 account.

There are 2 main types of 529 plans, and they are as follows:

- 529 savings plans

- Prepaid tuition plans

529 savings plans are the most common type of 529 plan. Simply put, they involve the account holders contributing money, which is invested in a pre-set selection of options. Many of them offer target-date funds, which become more and more conservative as the beneficiary gets closer and closer to his or her college career.

On the other hand, prepaid tuition plans allow the account holders to lock in tuition at present rates for students who may not be going to college for years to come. These plans, however, are offered by a limited number of states and colleges.

9. Coverdell ESA

A Coverdell Education Savings Account (ESA) is a trust or custodial account created by the US government primarily to assist in paying qualified education expenses for the designated beneficiary of the account.

It can be used for shouldering college-related expenditures such as tuition and fees, books, school supplies and even academic tutoring as well as special needs services. Besides helping to pay postsecondary education-related costs, a Coverdell ESA account may also be used for elementary and secondary education purposes.

However, in such an instance, Coverdell funds can be used for many other expenses, unlike 529 Plan funds.

Formerly known as Education Individual Retirement Account (IRA), Coverdell ESA makes it possible for families to increase their investment earnings provided that the funds are used for the educational pursuits of their kids.

It’s true that more than a single ESA account can be created for a single beneficiary. However, the total maximum contribution each year for any single beneficiary is only $2,000.

It’s also a must for the funds to be used by the time the beneficiary reaches 30 years of age. Otherwise, withdrawals will be accompanied by taxes and fees as well as penalties.

Setting up a Coverdell ESA account necessitates meeting certain requirements.

For one, the designated beneficiary must either be under 18 years of age or be a special needs beneficiary upon the establishment of the account. Also, when the account is created, it must be designated as Coverdell ESA. It’s important, too, for the document creating and governing the Coverdell ESA account to be in writing.

10. Mutual Funds

Mutual fund investments are a type of investment where many individuals pool their money to buy various assets, including stocks and bonds, and are managed by a financial advisor or bank investment specialist.

Profits made are then divided among investors, depending on the total amount of money invested.

Many students think that mutual fund investing is limited to the elderly or wealthy people. While there’s no denying that it’s quite popular among the said individuals, it’s also suitable for young people, most especially those who do not have a steady income source. Needless to say, those who are planning on going to college could benefit from it.

In addition, there’s no specific age to invest in mutual funds. As a matter of fact, even minors can start investing, although they will have to get the help of their parents or guardians until they turn 18 years old.

There’s no limit as to how much students can invest. Also, they can spend the funds they save on anything.

While there are many perks that come with mutual fund investing for college purposes, there are also a few downsides. For instance, mutual fund earnings are subject to taxes. Assets owned by a parent, meanwhile, can impact financial aid eligibility as FAFSA regards money from mutual funds as income.

How to Reduce Tuition Amount

Reducing the steep cost of tuition and college attendance in general can be done in different ways. By planning carefully as well as making informed decisions, it’s possible for students, especially those from low-income backgrounds, to earn an undergraduate degree without taking out a lot of loans and paying off a lot of interest.

Let’s end this post on how to pay for college by talking about some of the ways to lower the cost of attendance.

Pick Affordable Colleges

Public colleges are cheaper than private colleges.

Among public institutions of higher education, in-state colleges are cheaper than out-of-state ones, which is why students from low-income backgrounds and who wish to work on the most affordable undergraduate degree possible should consider attending colleges and universities in their home states.

Why in-state colleges are cheaper is that students are from resident families that pay tax dollars.

On average, tuition at in-state colleges amounts to $9,212. On the other hand, for the same degree, the average tuition at out-of-state colleges costs $26,382 — that’s a difference of $17,170.

Helping to bring down the cost of college even more for students who are attending in-state colleges is the fact that they are closer to their homes, which means that they do not have to reside on campus or rent an apartment near the school or enjoy lower transportation fees for commuter students.

US News says that these colleges have the most affordable out-of-state tuition costs:

- Mississippi Valley State University: $7,334

- University of North Carolina – Pembroke: $7,496

- Mississippi University for Women: $7,866

- Oklahoma Panhandle State University: $7,961

- Elizabeth City State University: $8,047

- West Liberty University: $8,150

- Western Carolina University: $8,453

- Minot State University: $8,508

- St. Petersburg College: $8,513

- Alcorn State University: $8,549

When computing total education costs, college-bound teens should take into account the fact that while public colleges have generally lower tuition costs, private colleges tend to offer higher financial aid packages.

Get Good Grades

Besides successfully completing a degree program, getting good grades is also key to bringing down the cost of college because it can help increase a student’s eligibility for merit-based financial aid.

We earlier talked about grants and scholarships, and it was mentioned that most scholarships are merit-based.

Just like what the name suggests, merit-based aid is financial assistance granted based on a variety of talents and interests, and academic achievement is included. Since good grades serve as proof of a student’s ability to meet high educational benchmarks, he or she may be eligible to apply for and receive merit financial assistance.

On the other hand, need-based aid is awarded based solely on the income and assets of the student or his or her family. It’s a must to note that some recipients of need aid must maintain a certain minimum GPA to remain eligible.

And speaking of GPA, the cumulative GPA requirement for merit-based aid can vary.

In some instances, it depends on the institution.

For instance, at St. Lawrence University, which has a US News ranking of #68 in National Liberal Arts Colleges, students who are getting merit-based aid must have a minimum 3.0 GPA. But it’s important to remember that most elite schools, including the Ivy Leagues, do not offer any merit aid.

The average merit-based aid awarded to full-time undergraduate students among 1,032 ranked colleges was $12,088 in the academic year 2022 to 2023.

Apply Early

Applying early to colleges may help students enjoy higher financial aid packages.

Postsecondary institutions and states do not have finite amounts of aid available. And, in most instances, financial aid funds are given on a first-come, first-served basis.

By applying early, college-bound teens who tick most, if not all, admission factor boxes receive acceptance letters earlier, thus allowing them to decide whether or not they will grab the offer to enroll, too.

By agreeing to attend early, they can file the FAFSA form ahead of everybody else, which helps increase their chances of getting more award money.

This is especially true for institutions with a priority deadline for financial aid.

As a matter of fact, students who submit the FAFSA between October and December (the federal deadline for FAFSA filing is June 30) get, on average, twice as many grants than students who file the FAFSA at much later dates.

While it’s true that applying early may make an undergraduate degree cheaper with the help of more aid, students should be strategic about it.

For instance, because early decision is binding, which means that students have to attend when accepted, they won’t be able to compare financial aid offers and opt for the most generous.

On the other hand, early action isn’t binding, which allows them to compare financial aid packages beforehand.

Read Next: Early Decision vs. Early Action Admission Plans

Disclaimer: The views and opinions expressed in this article are those of the authors and do not necessarily represent those of the College Reality Check.

![How to Lower the EFC [Legally]](https://collegerealitycheck.com/wp-content/uploads/college-money-1025-768x576.jpg)