7 Ways to Lower the Student Aid Index (SAI) Legally

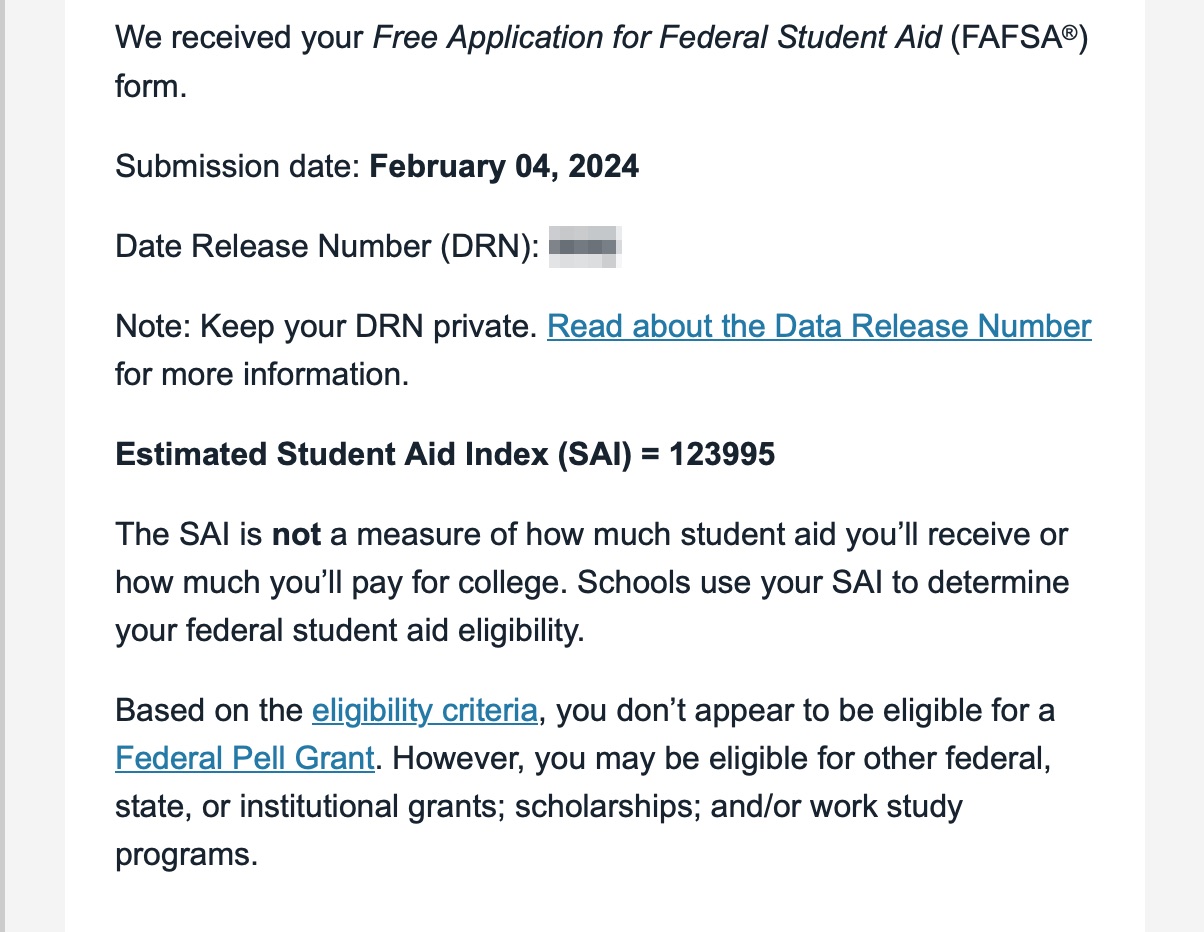

$123,995.

No, it’s not the cost of a new BMW or Land Rover.

It’s the Estimated Student Aid Index for my sophomore student this year. Last year, her EFC was $54,645.

I don’t know a single college that charges 123 grand for one year of tuition, but apparently, the government believes that this is what I can do (I can’t and I won’t).

So, why did our EFC more than double, what is a student aid index, and is there a way to lower it?

I will answer all of these and other questions below.

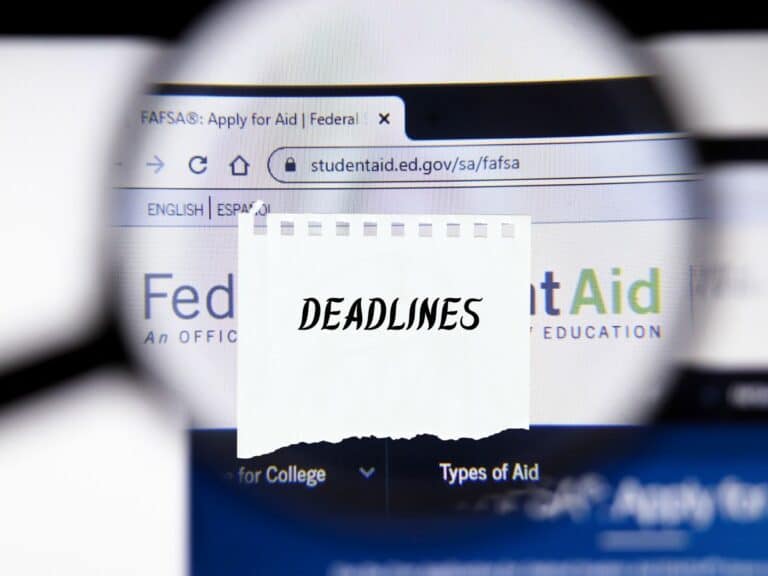

Let’s start with the new FAFSA.

What is Student Aid Index

The FAFSA Simplification Act is a provision of the Consolidated Appropriations Act.

It didn’t just simplify the FAFSA form by reducing the questions from 108 to 36. It also replaced the Expected Family Contribution (EFC).

Enter the Student Aid Index (SAI).

Like the EFC, the SAI remains a critical factor in deciding a student’s demonstrated financial need — the federal government, states, colleges, and scholarship providers will use the SAI in determining financial aid packages.

The fundamental rule is simple:

The lower the SAI, the higher the financial need, and the greater the eligibility for financial aid.

However, this time around, keeping the SAI low is a different ball game from keeping the EFC low.

For instance, unlike the EFC, the SAI does not consider the number of family members going to college — before, having multiple college students in the family means reduced EFC for each.

While $0 is the lowest EFC number, it’s as low as -$1,500 for the SAI.

The permission of negative numbers targets the neediest of all FAFSA applicants.

Since there are changes in the way the SAI is determined, some of the steps to lowering the EFC no longer apply to lowering the SAI to increase your financial aid eligibility.

Before we talk about them, let’s answer some pressing questions:

Why was EFC Renamed to SAI?

For years, many students and their families misinterpreted the EFC.

Expected family contribution — it’s plain to see (well, at least to a lot of people) that it’s what families should expect to contribute to the cost of their kids’ college education.

So, in other words, they think that the EFC is all they’ll have to pay.

Unfortunately, that’s not what EFC means:

It’s just an index of the family or student’s ability to pay, which will help determine how much financial aid the college student is eligible for.

Replacing the EFC with the Student Aid Index makes it easier to understand what it is.

Will SAI Be Higher Than EFC From the Previous Year?

Mine sure was.

However, your SAI may or may not be higher than your EFC from your previous FAFSA.

It’s not unlikely for your SAI to be different from your EFC because of one important component removed from the SAI.

And it’s none other than the number of college students in the family.

Because the FAFSA now completely disregards how many siblings you have in college, you can no longer count on having more degree-seeking students in your household to increase your financial aid award.

Let’s compare the steps in computing the SAI and EFC for dependent students:

EFC:

- Parents’ contribution from income and assets

- Divided by the number of kids in college

- Plus student’s contribution from income

- Plus student’s contribution from assets

SAI:

- Parents’ contribution from income and assets

- Plus student’s contribution from income

- Plus student’s contribution from assets

There are also significant changes to the SAI’s income components, too.

First, a reduction in the number of income components.

With most income items found on a US income tax return, the need for the FAFSA applicant to self-report income from untaxed sources becomes unnecessary.

Second, the addition of untaxed or tax-exempt portions of items on a US income tax return in the formula.

They include tax-exempt interest and untaxed IRA or pension distributions, excluding rollovers.

Asset components also involve some changes in determining the estimated student aid index.

With the SAI replacing the EFC, families must report more assets such as the annual amount of child support received, the value of a family farm, and the net worth of all businesses no matter the size.

As a result, you may have a higher SAI.

Why is Your SAI So High?

In most instances, a FAFSA applicant has a substantially increased SAI due to a high family income.

Similar to the EFC, the higher the household income, the higher the SAI gets — it’s easy to assume that you can pay the sticker price if you’re from a high-income background.

- Are my parents making too much money for financial aid?

- Will I get financial aid if my parents make over $100k?

- Can I get financial aid if I make over $100k?

Fortunately for students who are or whose parents are making a lot of money, income isn’t the only factor that determines their SAI, which means they may still demonstrate some need and be eligible for financial aid.

So, in other words, there is no income limit when it comes to the submission of the FAFSA form — you could still be eligible for aid even if you or your parents make a lot of money.

Of course, there’s a limit on how much an applicant can get based on income.

According to data from the National Center for Education Statistics (NCES), the following are the average FAFSA aid by income level and by the type of four-year college attended:

| Income Level | Public | Private Non-Profit | Private For-Profit |

|---|---|---|---|

| $0 – $30,000 | $12,300 | $28,110 | $7,310 |

| $30,001 – $48,000 | $11,830 | $31,320 | $7,920 |

| $48,001 – $75,000 | $8,900 | $29,940 | $6,900 |

| $75,001 – $110,000 | $5,080 | $26,570 | $5,970 |

| $110,001 or more | $3,060 | $22,370 | $7,000 |

Use the Estimated Student Aid Index Calculator

As the name suggests, an estimated SAI calculator is a tool that helps you get an SAI estimation, thus allowing you to have an idea of just how eligible you are to receive financial aid.

There are different SAI calculators on the web, but they work pretty much in the same manner.

Like filling out the FAFSA form, using an SAI calculator involves providing crucial details such as whether or not you are a dependent student, number of household members, income, assets, etc.

Here’s an example of an estimated SAI calculator from Mefa.

Lowering the SAI Without Breaking the Law

By increasing your demonstrated need, your eligibility for financial aid rises.

And to increase your demonstrated need, you have to lower your SAI.

Doing that is really simple: all you have to do is lower the numbers considered in the computation of a FAFSA applicant’s SAI, including income, assets, and any benefits you get.

However, it’s worth pointing out that lying on the FAFSA could have serious consequences.

You would be committing student fraud if you put lies on your FAFSA form for whatever reason, such as lowering your SAI to get the most generous financial aid package possible.

Such could result in fines of up to $20,000 or imprisonment of up to five years.

Or both!

And if you have already received some aid, the US Department of Education might force you to repay the amount awarded to you, and the college you attend might suspend you or even kick you out.

Fortunately, it’s possible to lower your SAI legally!

Reduce Your Assets by Paying off Debt

Reportable assets can impact the EFC.

So, in other words, the more reportable assets make it on the FAFSA form, the higher the cost of attendance to a college or university due to lower financial aid.

In order to lower the EFC, the goal is to turn some reportable assets into non-reportable assets.

This can be done through what’s referred to as sheltering assets.

Bear in mind that there is a world of difference between sheltering assets and hiding assets.

One of them can help make earning a degree easier on the pocket. Meanwhile, the other can get someone in trouble.

Sheltering assets for a more affordable college can be done in many different ways.

Some of the most common examples of turning reportable assets into non-reportable assets include:

- Making major purchases by the base year to reduce liquid assets.

- Using some of the assets to pay off mortgages, car loans, credit card debts, etc.

- Carrying out major repairs and maintenance needs before completing and filing the FAFSA form.

- Relatives who wish to contribute to college waiting until graduation to help pay off student loans.

- College-bound kids who are part of the family business not receiving any salary.

But like lowering the income, sheltering the asset is best done well before the base year.

It’s also a good idea to know that there may be limits to using a non-reportable asset to keep the SAI to a minimum.

For instance, a retirement plan is usually subject to contribution limits per year. This is why it may take several years before this approach can be used to one’s advantage.

One last note about mortgages.

While FAFSA does not take in account a home equity, CSS profile often does. Many of 200 most selective and most expensive colleges that use CSS profile use home equity to calculate financial aid.

So, if you student is applying to universities that use CSS profile paying of the mortgage may not be a good idea.

Increase Retirement Plan Contributions

Contributing more to qualified retirement plans, such as 401K, can disappear a reportable asset.

This is the biggest positive change in simplified FAFSA.

“Contributions to qualified retirement plans have historically and generally been categorized as untaxed income. FAFSA Simplification Act will generally remove those types of contributions from the income calculation formulas going forward, which will encourage parents to continue to make contributions into their retirement accounts while their children are in college going forward.”

InvestmentNews

If you are 50 or older, don’t forget to take advantage of catch-up contributions to the 401K plan.

Max Out HSA Plan

Another good change for high earners is that “starting with the 2024-25 award year under the FAFSA Simplification Act, annual contributions to HSAs are not reported on the FAFSA, are not included in need analysis, and are not treated as other financial assistance (OFA) when packaging the student with Title IV aid”, according to National Association of Student Financial Aid Administrators (NASFAA).

In my opinion, HSA is the best plan for retirement saving with multiple benefits.

First, you get a tax credit on the investment amount.

Second, the investment grows tax-free.

Third, withdrawals are also tax-free if spent on health-related expenses.

There is a catch, however.

You must have an eligible high-deductible health insurance plan, which may or may not work for you.

Skip Providing Non-Reportable Assets

The US Department of Education does not care about every single asset your family has.

It’s only interested in some of them.

Bad news!

As mentioned, compared to the EFC, the SAI considers more reportable assets — the more of them your family has, the lower your SAI and financial aid eligibility could get.

Here’s the summary of the asset component in the EFC formula:

- Cash, savings, and checking

- Net worth of investments, including real estate (excluding primary residence)

- Adjusted net worth of business and/or farm (excluding family farms or businesses with fewer than 100 full-time employees)

Meanwhile, here’s the summary of the asset component in the SAI formula:

- Cash, savings, checking, time deposits, and money market funds

- Net worth of investments, including real estate (excluding primary residence)

- Adjusted net worth of business and/or farm

- Annual child support received

If an asset is not on the list, never mention it on the FAFSA form.

Keep Assets in the Parents’ Name

Putting assets in the name of a child is beneficial in that it helps to boost tax savings.

It’s for the fact that the tax bracket for children is considerably lower than the tax bracket for adults.

There are downsides to this, however, which become evident when it’s time for the child to go to college.

First, it could keep him or her from being eligible for financial aid.

Second, he or she is not obligated to spend money toward attaining a college degree.

This is why parents should think twice before deciding to transfer assets into the name of their little one.

About 5-6% of the net value of the parental assets that count toward the EFC. On the other hand, student assets are weighted more heavily (20% for the FAFSA).

But if they already did and the child is about to attend college soon and they want to keep the EFC low, it’s a good idea to transfer their assets back to their name.

However, they should do so before the base year arrives.

Be an Independent Student

Are you willing to take a gap year or two or more for the sake of lowering your SAI?

Consider going to college and filling out the FAFSA form when you’re 24.

Being at least 24 years of age means you qualify as an independent student on the FAFSA, and it eliminates your parents’ income and assets in the SAI formula.

Again, here are the steps in computing the SAI of a dependent student:

- Parents’ contribution from income and assets

- Plus student’s contribution from income

- Plus student’s contribution from assets

Now, the following are the steps in computing the SAI of an independent student:

- Student’s contribution from income

- Plus student’s contribution from assets

As a general rule of thumb, most independent students have lower SAIs than dependent students.

Waiting until you’re 24 isn’t the only way to become an independent student.

Here are some other ways to become one:

- Get married

- Become an emancipated minor

- Support yourself

- Have a dependent child

- Be an active-duty military service personnel

Consider Appealing Financial Aid Decision

Remember a jaw-dropping number at the beginning of this post?

The increase was attributed to the partial sale of my business two years ago, which contributed to elevated income.

However, it was a one-time event. My income was much smaller last year, and there is a reason to expect that it will remain lower in the near future.

So, if you had a similar one-time increase in income in the base year, such as a big bonus or sale of a business, or if you had a loss of job of one parent in a two-income family, consider appealing a financial decision with the college.

You need to mention that while you received a lot of money in the base year, it was not a case a year prior or a year later.

It’s always worth trying because the college will not rescind the offer if you ask for more money, but don’t be surprised if your appeal is denied.

The rationale the university would have is that your student will be in school for multiple years. So, if you are not eligible for aid this year, you might be eligible for it next year (with less income).

Other Things To Do To Pay for Cost of Attendance

Since you are reading this article, I assume that your family either earns above-average or has above-average assets.

I wrote another article specifically about paying college costs for high income families. You can check it here.

Disclaimer: The views and opinions expressed in this article are those of the authors and do not necessarily represent those of the College Reality Check.